|

ELECTRICITE de FRANCE

AUTOMOTIVE A - Z CLIMATE CHANGE CONTACT E.CARS EVENTS GROWTH A - Z HOME PLEASE USE OUR A TO Z INDEX TO NAVIGATE THIS SITE

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Never

mind the Planet, the old and all those bloody conservationists. EDF

want more profit for its shareholders

In

August of 2012, EDF Energy sent a bill to The Old Steam House for

£29.00 to be paid by the 13th of September 2012. Not a problem, but the

bill was addressed to a defunct company, and this had come to a head,

with Trustees having to take it in turns to pay in person. Lime Park Heritage Trust (LPHT)

realized that they could not

pay an energy bill that their Trust wished to take responsibility for, because

the bill was not

addressed to the Trust, but to a Company that had long since ceased

trading. The Trust wrote to EDF's Richard Hughes explaining the

problem and asking him/EDF if they would be so good as to re-issue the

bill/invoice for £29.00 with the correct name of the LPH Trust attaching.

It was necessary to write, because when a Trustee used EDF's telephone

helpline for this purpose, he was told by EDF's customer services that

they could not deal with the matter via the phone. On

the 3rd of September 2012, Lime Park Heritage Trust faxed a letter to

Customer Services, EDF Energy, Osprey House, Osprey Road, Exeter, EX2

7WN using the Fax No: 01903 283224. The transmission was verified as

received OK and a print out to confirm filed. This letter explained the

situation and asked for a bill to be sent to the Trust, rather than the

defunct company. The

Heritage Trust did not receive an amended bill, but on the 19th of

September 2012, the same incorrectly addressed bill was received from Richard

Hughes, the SME Director. This time as a reminder.

It appeared to LPHT that their mail may have crossed in the post. Thus,

on the 20th of September 2012, another letter was faxed to 01903 283224,

again addressed to Richard Hughes. This time to be sure that Mr Hughes

was getting his mail, the Trust also sent a copy of the correspondence

so far, by Recorded Delivery. Docket

number: AI 5059 7233 8GB - at a cost of £1.45. The

running total is now 2 x letters @ £10 each, 2 x faxes @ £0.50p each,

giving a total of £22.40, for a bill that is only £29.00. You

would think that would be sufficient to put this matter to rest. You'd

be wrong. It appears that once EDF send a bill, rightly or wrongly, they

want it paid. We thought that in the United Kingdom, a paying customer

is always right. Not so. EDF want what is wrong to be right. They are

quite prepared to send out umpteen incorrect bills, rather than take a

payment on a correct bill. Even if they cannot chase a defunct company,

they'd rather die trying. You

should not forget at this point, that the Trust has spoken in person to

EDF customer services using their 0800 096 7361 and 0800 096 2255

numbers. A very friendly lady input all the correct information on EDF's

computer and confirmed that an amended bill would be sent out

immediately. But, no, a correct bill has not been recieved. Then

on the 10th of October 2012, EDF's Richard Hughes, re-submitted the

original incorrect bill, this time threatening disconnection, a visit

and legal action - of the £29.00 was not paid. We

wonder if EDF are aware of the Human Rights Act 1998, Section 6, and

Article 8, taken together with Protocol 1, Article 1? These parts

of the HRA 98, guarantee us peaceful enjoyment of property. You may care

to agree, that so far EDF have not complied with the HRA 98, but rather

are straying into Harassment Act 1998 territory. Trying

to be nice about this, the Trust wrote again on the 24th of October

2012, again setting out the position for EDF, near enough begging them

to send the amended bill, so that the Trust could pay. This letter was

faxed to 01903 283244, and again sent by recorded delivery, under Royal

Mail docket No: AU 2578 7593 4GB, at a cost of £1.45. The

cost to our Trust at this point is now £22.40 + £0.50 + £1.45

(postage) + £10.00 (letter) = £34.35. And think of the poor trees. The

cost to our administration is now £5.35 more than the £29.00

outstanding and we have charitable objects. To

make matters worse, EDF increased their bill to £43.74, knowing that

the previous company, only owed £29.00. We believe that this might be

culpable overcharging, or worse, a breach of the Fraud Act 2006. We say

this because the Fraud Act says that causing any person loss by

omission, is classed as fraud. See Sections 1 -4. Once

again the Trust believed that such a big company could not possibly fail

to look at their system and see that they'd agreed to send out a

correctly addressed bill. That is a bill addressed to the Lime Park

Heritage Trust. But

no. On the 5th of November 2012, another incorrect bill was received.

This time threatening to charge Late Payment Penalties. Well. We

consider that we have conducted ourselves reasonably, by doing our best

to get payment to EDF, for a bill that goes back to August 2012 - at

considerable time and expense to ourselves. It

is not possible to deal with a company who continually ignores

communications, and threatens sanctions, when it is their own

maladministration that is to blame. Just

snapping a few pictures to remind me what London looked like before disaster OFGEM: The

next step has got to be to take this to the Energy Ombudsman or Ofgem,

and that is what we are doing now. We will keep you posted as to the

outcome. According to the Ofgem website, the correct procedure is to

complaint to the Energy Ombudsman

Making a Complaint a clear explanation of the allegations, a description of the harm being caused, an indication of the legal obligation which may have been breached, details of the company or individual complained of, a description of your own business or interest. ABOUT

THE ENERGY OMBUDSMAN:

WATCHDOG

LINKS http://www.ombudsman-services.org/energy.html http://www.ofgem.gov.uk/About%20us/enforcement/complaint/Pages/Complaint.aspx As

you probably know, if an estimated bill is provided and the reading is

off, you can telephone EDF to request a new bill with a correct reading.

Because EDF repeatedly ignored our correspondence, we lodged complaint

online under reference number: WEBENER052134C It is not fair that we

should continue to write and fax without reply, and still to be

threatened. Trustees

who pay out of their own pocket, must provide a bill that is made out to

the Trust. It's a fairly straight forward matter and one which EDF must

have come across in the past. If a Trustee pays a bill not directed

to LPHT, that money cannot be repaid and the trustee foots the bill

personally. But

the historic remains at Herstmonceux do not have a beneficial use due to

bungling officials from Wealden District Council, who it seems, took it

upon themselves to lie to one of the Secretary of State's Inspectors at

a planning appeal. If

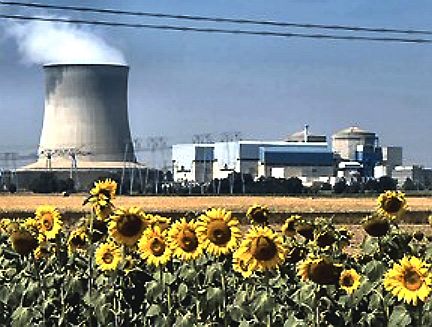

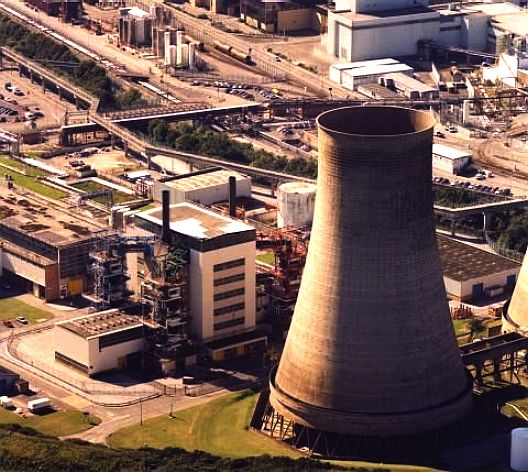

EDF can't get this right, should anyone trust them with Nuclear Power

Plants? ABOUT

EDF EDF Energy is an integrated energy company in the United Kingdom, with operations spanning electricity generation and the sale of gas and electricity to homes and businesses throughout the United Kingdom. It employs over 20,000 people and handles 5.7 million customer

accounts.

History Electricity generation Nuclear Renewable energy VINCENT

de RIVAZ - EDF CEO Vincent

de Rivaz is quoted as being a man on a mission. Ostensibly that mission is to persuade the UK Government to let EDF build and operate nuclear power stations and make a healthy return on its investment, thank you very much. EDF may even try to buy the Government's 60pc stake in BE, which Rothschild has been mandated to sell.

Carbon Intensity

NUCLEAR POWER & EDF ENERGY - MARCH 2012

The chief executive of EDF Energy has predicted that Germany will pay a high cost for its veto on nuclear energy as it drives to build on its leading position for renewable power capacity.

www.clickgreen.org.uk/news/edf-chief-says-germany-pay-price-renewable-energy-success

INSURANCE

Indirect nuclear insurance subsidy Kristin Shrader-Frechette has said "if reactors were safe, nuclear industries would not demand government-guaranteed, accident-liability protection, as a condition for their generating electricity". No private insurance company or even consortium of insurance companies "would shoulder the fearsome liabilities arising from severe nuclear accidents".

EDF sponsored the London Eye

SPONSORSHIP

NUCLEAR INDUSTRY ASSOCIATION (NIA) - 24 October 2012

The Energy and Climate Change select committee met this week to scrutinise plans for Britain’s nuclear new build programme. EDF Energy CEO Vincent de Rivaz gave a virtuoso performance tackling some thorny issues head on.

Kirsty Alexander - NIA Communications

This will apply to all low carbon technologies, to create a level playing field. It will be paid for by the private sector, which gets its money from consumers and does not constitute a subsidy for nuclear. Vincent de Rivaz indicated today that he believes the strike price will be the solution, not the problem. By this I guess he means he is confident that the strike price will demonstrate that nuclear is the most competitive low carbon technology, and the best low carbon technology available to the UK.

http://uknuclear.wordpress.com/tag/new build/

A month ago Ed Miliband announced the next generation of nuclear power that is going to provide a sizable chunk of our energy – 11 new sites to be operational by 2017. But the fanfare over Britain’s nuclear future has been muffled somewhat by the head of EDF Energy, Vincent de

Rivaz, in an interview with the FT today.

www.badidea.co.uk/edf de Rivaz v Miliband on nuclear-investment/comment-page-13147

We can't get insurance for this risk - I wonder if the Government will be daft enough to foot the bill?

Nelson Kruschandl Says:

November 10th, 2012 at 1:10 am Investing in nuclear energy, is like injecting yourself with heroin. Sooner or later the backlash from cleaning up, is going to get us. By ‘us’, I mean the human race. We’re all going to have to go cold turkey – with radiation poisoning as a nice little problem for next generations. While EDF cleans up cash wise now, who will pay for decommissioning and the other long term radiation problems. If this is to be allowed to happen, the people – with the government representing their interests, should insist on a fund for Tsunami or other

Quake damage, claims against radiation sickness and the full cost of disposing of nuclear waste.

FUEL POVERTY 2011

Mr Huhne accused Labour chief Ed Miliband — formerly Energy Secretary — of failing to get a grip on the energy crisis.

LINKS

EDF Group 2007 Annual Report, PDF page 72". EDF Group. About British Energy British Energy Shareholder Information EDF Energy Department of Energy and Climate Change ‘Digest of UK energy statistics’ (DUKES) West Burton Combined Cycle Gas Turbine Station, EDF Web Site EDF Group 2007 Annual Report, PDF page 74 EDF Group Green Electricity… Are you being conned The Ecologist. June 1, 2005 EDF Energy powers MarineCurrent Turbine's First Commercial Prototype EDF Renewables Generation & Development Performance Report EDF Group 2007 Annual Report, PDF page 75 EDF Group EDF Energies Nouvelles and EDF Energy to form joint venture in the United Kingdom Ecotricity threatens legal action against EDF in green Union flag row New EDF Energy partnership to deliver help on your doorstep EDF Energy website, accessed 07 August 2012 EDF Energy's Fuel Mix for 2006 EDF Energy's Fuel Mix for 2007

Clean energy from wind generation

ENERGY GENERATING-DISTRIBUTION UTILITIES

TOP ELECTRICITY POWER COMPANIES A - Z

According to Power-Technology.com, a website that provides market and customer insights in this sector, they listed these power companies (according to the 2018 Forbes calculation of net market capitalization, assets, sales and profit) as the biggest utilities:

KEPCO Korean Electric Power Corporation National Electric Grid & Central Electricity Authority (India) National Energy Board (Canada) National

Grid plc (formerly Central Electricity

Generating Board UK) State Grid Corporation of China TEPCO Tokyo Electric Power Company

LINKS and REFERENCES

Contact us

SMARTGRID - Service stations that use standard energy cartridges with (smart) compatibility built in for universal rapid charging of cars, buses and trucks - one size fits all.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

This

website

is Copyright © 1999 & 2020 Electrick Publications.

The blue bird

|