|

BANKS

|

|||

|

HOME | BIOLOGY | FILMS | GEOGRAPHY | HISTORY | INDEX | INVESTORS | MUSIC | NEWS | SOLAR BOATS | SPORT |

|||

|

A bank is an institution that provides financial service, particularly taking deposits and extending credit.

Currently the term bank is generally understood as an institution that holds a banking license. Banking licenses are granted by bank regulatory authorities and provide rights to conduct the most fundamental banking services such as accepting deposits and making loans. There are also financial institutions that provide certain banking services without meeting the legal definition of a bank, a so called non-banking financial company.

Banks have a long history, and have influenced economies and politics for centuries.

The word bank is derived from the Italian banca, which is derived from German language and means bench. The terms bankrupt and "broke" are similarly derived from banca rotta, which refers to an out-of-business bank, having its bench physically broken. Money lenders in Northern Italy originally did business in open areas, or big open rooms, with each lender working from his own bench or table.

Traditionally, a bank generates profits from transaction fees on financial services and from the interest it charges for lending. In recent history, with historically low interest rates limiting banks' ability to earn money by lending deposited funds, much of a bank's income is provided by overdraft fees and riskier investments.

Banks in the economy

Role in the money supply

A bank raises funds by attracting deposits, borrowing money in the inter-bank market, or issuing financial instruments in the money market or a capital market. The bank then lends out most of these funds to borrowers.

However, it would not be prudent for a bank to lend out all of its balance sheet. It must keep a certain proportion of its funds in reserve so that it can repay depositors who withdraw their deposits. Bank reserves are typically kept in the form of a deposit with a central bank. This behaviour is called fractional-reserve banking and it is a central issue of monetary policy. Some governments (or their central banks) restrict the proportion of a bank's balance sheet that can be lent out, and use this as a tool for controlling the money supply. Even where the reserve ratio is not controlled by the government, a minimum figure will still be set by regulatory authorities as part of bank regulation.

Size of global banking industry

Worldwide assets of the largest 1,000 banks grew 15.5% in 2005 to reach a record $60.5 trillion. This follows a 19.3% increase in the previous year. EU banks held the largest share, 50% at the end of 2005, up from 38% a decade earlier. The growth in Europes share was mostly at the expense of Japanese banks whose share more than halved during this period from 33% to 13%. The share of US banks also rose, from 10% to 14%. Most of the remainder was from other Asian and European countries.

The US had by far the most banks (7,540 at end-2005) and branches (75,000) in the world. The large number of banks in the US is an indicator of its geographical dispersity and regulatory structure resulting in a large number of small to medium sized institutions in its banking system. Japan had 129 banks and 12,000 branches. In Western Europe, Germany, France and Italy had more than 30,000 branches each. This was twice the number of branches in the UK. [1]

Bank crises

Banks are susceptible to many forms of risk which have triggered occasional systemic crises. Risks include liquidity risk (the risk that many depositors will request withdrawals beyond available funds), credit risk (the risk that those that owe money to the bank will not repay), and interest rate risk (the risk that the bank will become unprofitable if rising interest rates force it to pay relatively more on its deposits than it receives on its loans), among others.

Banking crises have developed many times throughout history when one or more risks materialize for a banking sector as a whole. Prominent examples include the U.S. Savings and Loan crisis in 1980s and early 1990s, the Japanese banking crisis during the 1990s, and the bank run that occurred during the Great Depression, and the recent liquidation by the central Bank of Nigeria, where about 25 banks were liquidated.

Regulation

The combination of the instability of banks as well as their important facilitating role in the economy led to banking being thoroughly regulated. The amount of capital a bank is required to hold is a function of the amount and quality of its assets. Major banks are subject to the Basel Capital Accord promulgated by the Bank for International Settlements. In addition, banks are usually required to purchase deposit insurance to make sure smaller investors are not wiped out in the event of a bank failure.

Another reason banks are thoroughly regulated is that ultimately, no government can allow the banking system to fail. There is almost always a lender of last resortin the event of a liquidity crisis (where short term obligations exceed short term assets) some element of government will step in to lend banks enough money to avoid bankruptcy.

Profitability

Large banks in the United States are some of the most profitable corporations, especially relative to the small market shares they have. This amount is even higher if one counts the credit divisions of companies like Ford, which are responsible for a large proportion of those company's profits. For example, the largest bank, Citigroup, which for the past 3 years has made more profit than any other company in the world, has only a 5% market share. Now if Citigroup were to be as dominant in its industry as a Home Depot, Starbucks, or Wal Mart in their respective industries, with a 30% market share, it would make more money than the top ten non-banking U.S. industries combined.

In the past 10 years in the United States, banks have taken many measures to ensure that they remain profitable while responding to ever-changing market conditions. First, this includes the Gramm-Leach-Bliley Act, which allows banks again to merge with investment and insurance houses. Merging banking, investment, and insurance functions allows traditional banks to respond to increasing consumer demands for "one stop shopping" by enabling cross-selling of products (which, the banks hope, will also increase profitability). Second, they have moved toward risk-based pricing on loans, which means charging higher interest rates for those people who they deem more risky to default on loans. This dramatically helps to offset the losses from bad loans, lowers the price of loans to those who have better credit histories, and extends credit products to high risk customers who would have been denied credit under the previous system. Third, they have sought to increase the methods of payment processing available to the general public and business clients. These products include debit cards, pre-paid cards, smart-cards, and credit cards.

These products make it easier for consumers to conveniently make transactions and smooth their consumption over time (in some countries with under-developed financial systems, it is still common to deal strictly in cash, including carrying suitcases filled with cash to purchase a home). However, with convenience there is also increased risk that consumers will mis-manage their financial resources and accumulate excessive debt. Banks make money from card products through interest payments and fees charged to consumers and companies that accept the cards.

The banks' main obstacles to increasing profits are existing regulatory burdens, new government regulation, and increasing competition from non-traditional financial institutions.

THE TOP TEN BANKS

Top ten banking groups in the world ranked by tier 1 capital in 2004 (in U.S. dollars)

Top ten banking groups in the world ranked by assets in 2004 (in U.S. dollars)

Top ten bank holding companies in the world ranked by profit in 2003 (in U.S. dollars)

Top ten bank holding companies in the U.S. ranked by deposits (in U.S. dollars)

As of June 30, 2004. These are U.S. deposits only. This is not a ranking of the largest U.S.-based global banks.

LINKS:

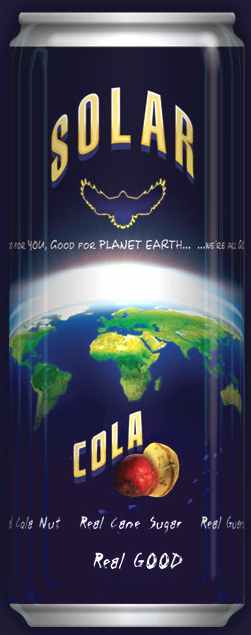

SOLAR COLA as an INVESTMENT OPPORTUNITY?

The soft drinks market is a tough place to do business, unless you have something different to offer and the marketing muscle to match.

For nearly 100 years Coca Cola and Pepsi Cola have dominated the marketplace with similar products. Each company spends around $600-800 million dollars a year to maintain its market position. The advertising centers around sport and music, with a scattering of irregular television campaigns. Each company launches (or attempts to launch) new brands every year. So far, they have not proved as successful as their regular cola brands.

Red Bull, although in a different drinks category, spends not quite as much on advertising , but has managed to acquire instant status and volume sales from sponsoring formula one, the Darpa Desert Challenge, and now the New Jersey MetroStars football team.

Solar Cola, apart from it's contemporary name, is a healthier cola based drink. Just as refreshing, it contains a unique blend of added ingredients as an aid to good health and energy levels. The company contributes to and sponsors alternative projects, to include this website, featuring movies, music and several thousand pages of general information, which generates in excess of 3 million visits a month already. Recent acquisitions include the rights to the Solar Navigator World Electric Challenge, and also the new Bluebird Electric land speed record car for 2007. The company may also sponsor the London to Brighton Solar Car Run in 2008 (dependent on the number of university entries received).

It is thought that this marketing strategy will equal several hundred thousand dollars of conventional Ad Agency spending. As an example of the kind of media coverage such nautical antics generate, you have only to look at the newspapers when Ellen Macarthur completed her world circumnavigation. The same holds true for Sir Francis Chichester and Sir Robin Knox-Johnston.

The design of the Solar Cola can is copyright protected, with trademark applications in the USA, Australia and Europe pending in Class 32 and granted rights in the UK. Introduction of the drink is held in abeyance pending official launch of one or other sponsored projects, which will be activated when the time is right, such activation to coincide with the market introduction of the drink.

Solar Cola PLC is shortly to be activated for online investment as their trading arm. The company is forecast to produce excellent results for investors, with sustained growth to be followed by an eventual flotation on the Stock Markets of the world in the next few years. At this point estimates suggest investors will reap substantial gains - in line with international Licensing expectations.

Solar Cola Ltd is managing the funding requirement for the trading company. They are looking for medium term or seed investment between £4-5 million to kick start phase two of the venture.

If you are a Business Angel, or Equity House, looking for an opportunity with the potential for good returns, please contact SOLAR COLA LTD for details. Please ask for the funding project manager: Katherine Hudson

0044 1323 831727 0044 7941 370 241

MONEY FINDER

New energy drinks for performers

.. Thirst for Life

330ml Earth can - the World in Your Hands

|

|||

|

This

website

is Copyright © 1999 & 2008 NJK. The bird |

|||

|

AUTOMOTIVE | BLUEBIRD | ELECTRIC CARS | ELECTRIC CYCLES | SOLAR CARS |