|

TAX HAVENS

|

||

| HOME | BIOLOGY | FILMS | GEOGRAPHY | HISTORY | INDEX | INVESTORS | MUSIC | NEWS | SOLAR BOATS | SPORT | ||

|

A tax haven is a place where certain taxes are levied at a low rate or not at all. This encourages wealthy individuals and/or firms to areas that would otherwise be overlooked. Different jurisdictions tend to be havens for different types of taxes, and for different categories of people and/or companies.

Taxation worldwideMost countries

Most countries impose taxes on income earned or gains realised within that country regardless of the country of residence of the person or firm. Most countries also tax their residents (individuals and companies) on all their worldwide income.

One way a person or company takes advantage of tax havens is by moving to, and becoming resident for tax purposes in, an appropriate country. Another way for an individual or a company to take advantage of a tax haven is to establish a separate legal entity (an offshore company, trust or foundation), subsidiary or holding company there. Assets are transferred to the new company or trust so that gains may be realised, or income earned, within this legal entity rather than earned by the beneficial owner. United States

The United States is unlike most other countries in that its citizens are subject to U.S. tax on their worldwide income no matter where in the world they reside. U.S. citizens therefore cannot avoid U.S. taxes either by emigrating or by transferring assets abroad. According to Forbes magazine some nationals choose to give up their United States citizenship rather than be subject to the U.S. tax system [1].

However, U.S. citizens who reside (or spend long periods of time) outside the U.S., may be able to exclude up to US$80,000 (or foreign equivalent) of salaried income earned overseas (but not other types of income), as well as foreign housing expenses. Additionally, the U.S. will normally allow a U.S. citizen to subtract any foreign income taxes paid on foreign sourced income, from the U.S. income tax due on that income. Also, U.S. citizens do have the option of setting up an offshore foundation or trust, which can be used as a tax reporting free entity. However, constraints exist on how the income is used. For example, foundations stipulate that funds must be used for altruistic purposes.

Incentives for the tax haven

Reasons for becoming a tax haven are several. Some nations may find they don't need to charge as much as some industrialised countries in order for them to be earning sufficient income for their annual budgets. Some may offer a lower tax rate to larger corporations, in exchange for the companies locating a division of their parent company in the host country and employing some of the local population. Other domiciles find this is a way to encourage conglomerates from industrialised nations to transfer needed skills to the local population. Still yet, some countries simply find it costly to compete in many other sectors with industrialised nations and have found a low tax rate mixed with a little self-promotion can go a long way to lure companies to their domiciles.

Many industrialised countries claim that tax havens act unfairly by reducing tax revenue which would otherwise be theirs. Claims are made that money launderers also use tax havens extensively, even though regulations in tax havens can actually make money laundering more difficult than in locations with a large black market such as New York City or London.

Examples of tax havens

Some tax havens including some of the ones listed above do charge income tax as well as other taxes such as capital gains, inheritance tax, and so forth. Criteria distinguishing a taxpayer from a non-taxpayer can include citizenship and residency and source of income. For example, in the Cayman Islands, one pays no tax if one earns all one's revenue from outside the country but one does pay tax if one earns income from within the country.

Amounts

While incomplete, and with the limitations discussed below, the available statistics nonetheless indicate that offshore banking is a very sizeable activity. IMF calculations based on BIS data suggest that for selected OFCs (Offshore Financial Centers), on balance sheet OFC cross-border assets reached a level of US$4.6 trillion at end-June 1999 (about 50 percent of total cross-border assets), of which US$0.9 trillion in the Caribbean, US$1 trillion in Asia, and most of the remaining US$2.7 trillion accounted for by the IFCs (International Financial Centers), namely London, the U.S. IBFs, and the JOM (Japanese Offshore Market).([2])

LINKS:

SOLAR COLA as an INVESTMENT OPPORTUNITY?

The soft drinks market is a tough place to do business, unless you have something different to offer and the marketing muscle to match.

For nearly 100 years Coca Cola and Pepsi Cola have dominated the marketplace with similar products. Each company spends around $600-800 million dollars a year to maintain its market position. The advertising centers around sport and music, with a scattering of irregular television campaigns. Each company launches (or attempts to launch) new brands every year. So far, they have not proved as successful as their regular cola brands.

Red Bull, although in a different drinks category, spends not quite as much on advertising , but has managed to acquire instant status and volume sales from sponsoring formula one, the Darpa Desert Challenge, and now the New Jersey MetroStars football team.

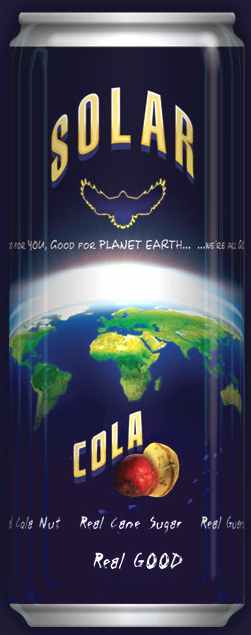

Solar Cola, apart from it's contemporary name, is a healthier cola based drink. Just as refreshing, it contains a unique blend of added ingredients as an aid to good health and energy levels. The company contributes to and sponsors alternative projects, to include this website, featuring movies, music and several thousand pages of general information, which generates in excess of 3 million visits a month already. Recent acquisitions include the rights to the Solar Navigator World Electric Challenge - 2009/10, and also the new Bluebird Electric land speed record car for 2007/8. The company may also sponsor the London to Brighton Solar Car Run in 2008 (dependent on the number of university entries received).

It is thought that this marketing strategy will equal several hundred thousand dollars of conventional Ad Agency spending. As an example of the kind of media coverage such nautical antics generate, you have only to look at the newspapers when Ellen Macarthur completed her world circumnavigation. The same holds true for Sir Francis Chichester and Sir Robin Knox-Johnston.

The design of the Solar Cola can is copyright protected, with trademark applications in the USA, Australia and Europe pending in Class 32 and granted rights in the UK. Introduction of the drink is held in abeyance pending official launch of one or other sponsored projects, which will be activated when the time is right, such activation to coincide with the market introduction of the drink.

Solar Cola PLC is shortly to be activated for online investment as their trading arm. The company is forecast to produce excellent results for investors, with sustained growth to be followed by an eventual flotation on the Stock Markets of the world in the next few years. At this point estimates suggest investors will reap substantial gains - in line with international Licensing expectations.

Solar Cola Ltd is managing the funding requirement for the trading company. They are looking for medium term or seed investment between £4-5 million to kick start phase two of the venture.

If you are a Business Angel, or Equity House, looking for an opportunity with the potential for good returns, please contact SOLAR COLA LTD for details of their business plan. Or for and informal chat, please ask for the funding project manager: Nelson Kruschandl

+ 44 (0) 1323 831727

MONEY FINDER

LINKS:

This material and any views expressed herein are provided for information purposes only and should not be construed in any way as a prospectus or offer. Please contact the company concerned for information of any business opportunity or specific program. Before investing in any business, you must obtain, read and examine thoroughly its disclosure document or offering memorandum.

Solar Cola drinkers care about climate chaos ...

.. Thirst for Life

(330ml Earth can)

|

||

|

This

website

is Copyright

© 1999 & 2008 NJK. The bird |

||

|

AUTOMOTIVE | BLUEBIRD | ELECTRIC CARS | ELECTRIC CYCLES | SOLAR CARS |