|

SHARES, STOCKS and DIVIDENDS

|

||

|

HOME | BIOLOGY | FILMS | GEOGRAPHY | HISTORY | INDEX | INVESTORS | MUSIC | SOLAR BOATS | SPORT |

||

|

SHARES

In finance a share is a unit of account for various financial instruments including stocks, mutual funds, limited partnerships, and REIT's. In British English, the usage of the word share alone to refer solely to stocks is so common that it almost replaces the word stock itself.

A share is one of a finite number of equal portions in the capital of a company, entitling the owner to a proportion of distributed, non-reinvested profits known as dividends and to a portion of the value of the company in case of liquidation. Shares can be voting or non-voting, meaning they either do or do not carry the right to vote on the board of directors and corporate policy. Whether this right exists often affects the value of the share.

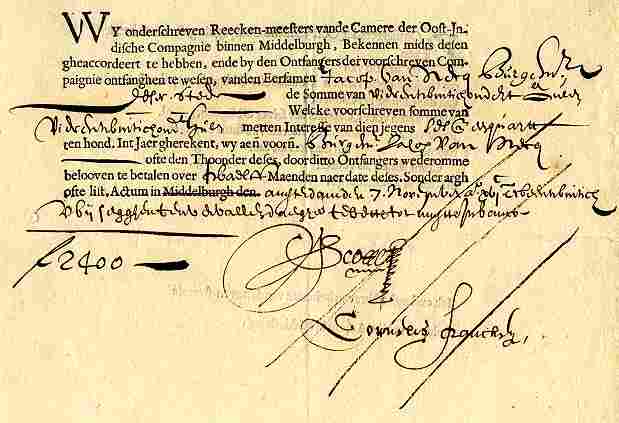

Stock bond Dutch East India Company 1623

STOCKS

In financial terminology, stock is the capital raised by a corporation, through the issuance and sale of shares. A shareholder is any person or organization which owns one or more shares of a corporation's stock. The aggregate value of a corporation's issued shares is its market capitalization. In British English, the word stock has a completely different meaning in finance, referring to a bond. It can also be used more widely to refer to all kinds of marketable securities. Where a share of ownership is meant the word share is usually used in British English. History

The first company that issued shares was the Dutch East India Company in the early 17th century (1602).

The innovation of joint ownership made a great deal of Europe's economic growth possible following the middle ages. The technique of pooling capital to finance the building of ships, for example, made the Netherlands a maritime superpower. Before the widespread adoption of the joint-stock corporation, an expensive venture such as building a merchant ship could only be undertaken by governments or by very wealthy individuals or families. Ownership

The owners of a company may want additional capital to invest in new projects within the company. They may also simply wish to reduce their holding, freeing up capital for their own private use. By selling shares they can sell part or all of the company to many part-owners. The purchase of one share entitles the owner of that share to literally share in the ownership of the company a fraction of the decision-making power, and potentially a fraction of the profits, which the company may issue as dividends.

In the common case, where there are thousands of shareholders, it is impractical to have all of them making the daily decisions required in the running of a company. Thus, the shareholders will use their shares as votes in the election of members of the board of directors of the company.

Each share constitutes one vote (except in a co-operative society where every member gets one vote regardless of the number of shares they hold). Owning the majority of the shares allows other shareholders to be out-voted - effective control rests with the majority shareholder (or shareholders acting in concert). In this way the original owners of the company often still have control of the company. Shareholder rights

Although owning 51% of shares does mean that you own 51% of the company, it does not give you the right to use a company's building, equipment, materials, or other property. This is because the company is considered a legal person, thus it owns all its assets itself. This is important in areas such as insurance, which must be in the name of the company and not the main shareholder.

In most countries, including the United States, boards of directors and company managers have a fiduciary responsibility to run the company in the interests of its stockholders. Nonetheless, as Martin Whitman writes:

Even though the board of directors runs the company, the shareholder has some impact on the company's policy, as the shareholders elect the board of directors. Each shareholder typically has a percentage of votes equal to the percentage of shares he or she owns. So as long as the shareholders agree that the management (agent) are performing poorly they can elect a new board of directors which can then hire a new management team. In practice, however, genuinely contested board elections are rare. Board candidates are usually nominated by insiders or by the board of the directors themselves, and a considerable amount of stock is held and voted by insiders.

Owning shares does not mean responsibility for liabilities. If a company goes broke and has to default on loans, the shareholders are not liable in any way. However, all money obtained by converting assets into cash will be used to repay loans and other debts first, so that shareholders cannot receive any money unless and until creditors have been paid (most often the shareholders end up with nothing). Means of financing

Financing a company through the sale of stock in a company is known as equity financing. Alternatively, debt financing (for example issuing bonds) can be done to avoid giving up shares of ownership of the company. Unofficial financing known as trade financing usually provides the major part of a company's working capital (day-to-day operational needs). Trade financing is provided by vendors and suppliers who sell their products to the company at short-term, unsecured credit terms, usually 30 days. Equity and debt financing are usually used for longer-term investment projects such as investments in a new factory or a new foreign market. Customer provided financing exists when a customer pays for services before they are delivered, e.g. subscriptions and insurance.

Trading

A stock exchange is an organization that provides a marketplace (either physical or virtual) for trading shares, where investors (represented by stock brokers) may buy and sell shares in a wide range of companies. A given company will usually list its shares in only one exchange by meeting and maintaining the listing requirements of that particular stock exchange. In the United States, through the inter-market quotation system, stocks listed on one exchange can also be bought or sold on several other exchanges, including relatively new internet-only exchanges. Stocks are broadly grouped into NYSE-listed and NASDAQ-listed stocks and exchanges where NYSE-listed stocks may be bought are generally not the same group as the exchanges where NASDAQ-listed stocks may be bought. Many large foreign companies choose to list on a U.S. exchange as well as an exchange in their home country in order to broaden their investor base. These shares are called American Depository Receipts (ADRs). Large U.S. companies also list in foreign exchanges for the same reason.

Buying

There are various methods of buying and financing stocks. The most common means is through a stock broker. Whether they are a full service or discount broker, they are all doing one thing—arranging the transfer of stock from a seller to a buyer. Most of the trades are actually done through brokers listed with a stock exchange such as the New York Stock Exchange.

There are many different stock brokers to choose from such as full service brokers or discount brokers. The full service brokers usually charge more per trade, but give investment advice or more personal service; the discount brokers offer little or no investment advice but charge less for trades. Another type of broker would be a bank or credit union that may have a deal set up with either a full service or discount broker.

There are other ways of buying stock besides through a broker. One way is directly from the company itself. If at least one share is owned, most companies will allow the purchase of shares directly from the company through their investor's relations departments. However, the initial share of stock in the company will have to be obtained through a regular stock broker. Another way to buy stock in companies is through Direct Public Offerings which are usually sold by the company itself. A direct public offering is an initial public offering in which the stock is purchased directly from the company, usually without the aid of brokers.

When it comes to financing a purchase of stocks there are two ways: purchasing stock with money that is currently in the buyers ownership or by buying stock on margin. Buying stock on margin means buying stock with money borrowed against the stocks in the same account. These stocks, or collateral, guarantee that the buyer can repay the loan; otherwise, the stockbroker has the right to sell the stocks (collateral) to repay the borrowed money. He can sell if the share price drops below the margin requirement, at least 50 percent of the value of the stocks in the account. Buying on margin works the same way as borrowing money to buy a car or a house using the car or house as collateral. Moreover, borrowing is not free; the broker usually charges 8-10 percent interest. Selling

Selling stock is procedurally similar to buying stock. Generally, the investor wants to buy low and sell high, if not in that order (short selling); although a number of reasons may induce an investor to sell at a loss.

As with buying a stock, there is a transaction fee for the broker's efforts in arranging the transfer of stock from a seller to a buyer. This fee can be high or low depending on which type of brokerage, discount or full service, handles the transaction.

After the transaction has been made, the seller is then entitled to all of the money. An important part of selling is keeping track of the earnings. Importantly, on selling the stock, in jurisdictions that have them, capital gains taxes will have to be paid on the additional proceeds, if any, that are in excess of the cost basis. Technology's influence on trading

Stock trading has evolved tremendously. Since the very first Initial Public Offering (IPO) in the 13th century, owning shares of a company has been a very attractive incentive. Even though the origins of stock trading go back to the 13th century, the market as we know it today did not catch on strongly until the late 1800s.

Co-production between technology and society has led the push for effective and efficient ways of trading. Technology has allowed the stock market to grow tremendously, and all the while society has encouraged the growth. Within seconds of an order for a stock, the transaction can now take place. Most of the recent advancements with the trading have been due to the Internet. The Internet has allowed online trading. In contrast to the past where only those who could afford the expensive stock brokers, anyone who wishes to be active in the stock market can now do so at a very low cost per transaction. Trading can even be done through Computer-Mediated Communication (CMC) use of mobile devices such as handheld computers and cellular phones. These advances in technology have made day trading possible.

The stock market has grown so that some argue that it represents a country's economy. This growth has been enjoyed largely to the credibility and reputation that the stock market has earned. Types of shares

There are several types of shares, including common stock, preferred stock, treasury stock, and dual class shares. Preferred stock, sometimes called preference shares, have priority over common stock in the distribution of dividends and assets, and sometime have enhanced voting rights such as the ability to veto mergers or acquisitions or the right of first refusal when new shares are issued (i.e. the holder of the preferred stock can buy as much as they want before the stock is offered to others). A multiple class equity structure has several classes of shares (for example Class A, Class B, and Class C) each with its own advantages and disadvantages. Treasury stock are shares that have been bought back from the public. Treasury Stock is considered issued but not outstanding.

Derivatives

A stock option is a class of option. Specifically, a call option is the right (not obligation) to buy stock in the future at a fixed price and a put option is the right (not obligation) to sell stock in the future at a fixed price. Thus, the value of a stock option changes in reaction to the underlying stock of which it is a derivative. The most popular method of valuing stock options is the Black Scholes Option Calculator Apart from call options granted to employees, many stock options are transferable.

DIVIDENDS

A dividend is the distribution or sharing of parts of profits to a company's shareholders.

Purpose

The primary purpose of any business is to create profit for its owners, and the dividend is the most important way the business fulfills this mission. When a company earns a profit, some of this money is typically reinvested in the business and called retained earnings, and some of it can be paid to its shareholders as a dividend. Paying dividends reduces the amount of cash available to the business, but the distribution of profit to the owners is, after all, the purpose of the business.

Types

The methods of sharing profits are as follows:

Dividends must be declared (i.e., approved) by a company’s Board of Directors each time they are paid. There are four important dates to remember regarding dividends.

Date of record: Shareholders who properly registered their ownership on or before this date will receive the dividend. Shareholders who are not registered as of this date will not receive the dividend. Registration in most countries is essentially automatic for shares purchased before the ex-dividend date.

Ex dividend date: Is set by the exchange where the stock is traded, several days (usually two) before the date of record, so that all trades made on previous dates can be properly settled and the shareholder list on the date of record will accurately reflect the current owners. Purchasers buying before the ex-dividend date will receive the dividend. The stock is said to trade cum dividend on these dates. Purchasers buying on the ex-dividend date or after will not receive the dividend. The stock trades ex-dividend on these dates.

Payment date: The date when the dividend checks will actually be mailed to the shareholders of a company.

Dividend-reinvestment plans

Some companies have dividend reinvestment plans, or DRIPs. These plans allow shareholders to use dividends to systematically buy small amounts of stock often at no commission. In some cases the shareholder might not need to pay taxes on these re-invested dividends, but in most cases they do.

Reasons why companies avoid paying cash dividends

Companies have often avoided paying cash dividends for several reasons:

Microsoft is an example of a company who has historically been a proponent of retaining earnings; it did so from its IPO in 1986 until 2003, when it declared it would start paying dividends. By this point Microsoft had accumulated over US$43 billion in cash, and there had been increasing irritation from stockholders who believed this large pile of cash should lie in their hands and not in the company's. Originally, the official reason to amass this large sum was to create a reserve for Microsoft's legal battles; since then, Microsoft appears to have changed tactics such that the reserve is not as necessary.

Franking Credits

In Australia and New Zealand, companies also forward franking credits to shareholders along with dividends. These franking credits represent the tax paid by the company upon its pre-tax profits. One dollar of company tax paid generates one franking credit. Companies can forward any proportion of franking up to a maximum amount that is calculated from the prevailing company tax rate: for each dollar of dividend paid, the maximum level of franking is the company tax rate divided by (1 - company tax rate). At the current 30% rate, this works out at 0.30 of a credit per 70 cents of dividend, or 42.857 cents per dollar of dividend. The shareholders who are able to use them offset these credits against their income tax bills at a rate of a dollar per credit, thereby effectively eliminating the double taxation of company profits. This system is called dividend imputation.

The UK's taxation system operates along similar lines: dividends come with an attached tax credit which ensures that double taxation does not take place.

About the name "Dividend"

The name comes from the arithmetic operation of division: if a / b = c then a is the dividend, b the divisor, and c the quotient.

In the United States, credit unions generally use the term "dividends" to refer to interest payments they make to depositors. These are not dividends in the normal sense and are not taxed as such; they are just interest payments. Credit unions call them dividends since, as credit unions are owned by their members, interest payments are effectively payments to owners.

In the United Kingdom, consumer co-operative societies use the term "dividend" for profit-sharing payments to their members. Unlike joint stock company dividends, these payments are made in proportion to a members' spending with the co-operative society, not the number of shares they hold in it.

LINKS:

Nelson Kruschandl - Entrepreneur looking for investors

SOLAR COLA as an INVESTMENT OPPORTUNITY?

The soft drinks market is a tough place to do business, unless you have something different to offer and the marketing muscle to match.

For nearly 100 years Coca Cola and Pepsi Cola have dominated the marketplace with similar products, but at this time they are losing ground to newer drinks with something more to offer. Each company spends around $600-800 million dollars a year to maintain its market position. The advertising centers around sport and music, with a scattering of irregular television campaigns. Each company launches (or attempts to launch) new brands every year. So far, they have not proved as successful as their regular cola brands and brand loyalty is an obstacle.

Red Bull, although in a different drinks category, spends not quite as much on advertising, but has managed to acquire instant status and volume sales from sponsoring formula one, the Darpa Desert Challenge, and now the New Jersey MetroStars football team.

A taste for adventure capitalists

Solar Cola - the healthier cola alternative

Solar Cola, apart from it's contemporary name, is a healthier cola based drink. Just as refreshing, it contains a unique blend of added ingredients as an aid to good health and energy levels. The company contributes to and sponsors alternative projects, to include this website, featuring movies, music and several thousand pages of general information, which generates in excess of 3 million visits a month already. Recent acquisitions include the rights to the Solar Navigator World Electric Challenge - 2009/10, and also the new Bluebird Electric land speed record car for 2007/8. The company may also sponsor the London to Brighton Solar Car Run in 2008 (dependent on the number of university entries received).

It is thought that this marketing strategy will equal several hundred thousand dollars of conventional Ad Agency spending. As an example of the kind of media coverage such nautical antics generate, you have only to look at the newspapers when Ellen Macarthur completed her world circumnavigation. The same was true for Sir Francis Chichester and Sir Robin Knox-Johnston.

The design of the Solar Cola can is copyright protected, with trademark applications in the USA, Australia and Europe pending in Class 32 and granted rights in the UK. Introduction of the drink is held in abeyance pending official launch of one or other sponsored projects, which will be activated when the time is right, such activation to coincide with the market introduction of the drink.

Solar Cola PLC is shortly to be activated for online investment as their trading arm. The company is forecast to produce excellent results for investors, with sustained growth to be followed by an eventual flotation on the Stock Markets of the world in the next five years. At this point estimates suggest investors will reap substantial gains - in line with international Licensing expectations.

Solar Cola Ltd is managing the funding requirement for the trading company. They are looking for medium term or seed investment between £4-5 million in total to kick start phase two of the venture. Accordingly, this may require co-operation between, and several Angel investors, or a mix of Equity House and private investors.

If you are a Business Angel, or Equity House, looking for an opportunity with the potential for good returns, please contact SOLAR COLA LTD for details of their business plan. Or for and informal chat, please ask for the funding project manager: Nelson Kruschandl

+ 44 (0) 1323 831727 +44 (0) 7905 147709

REFERENCES and LINKS:

This material and any views expressed herein are provided for information purposes only and should not be construed in any way as a prospectus or offer. Please contact the company concerned for information of any business opportunity or specific program. Before investing in any business, you must obtain, read and examine thoroughly its disclosure document or offering memorandum.

Share

Dealing with City Index

Share

Dealing Service - CMC Markets

Share

Dealing with Squaregain Today

Online

Trading at Barclays Stockbrokers

... Cheque Account SECURITY AND PRIVACY SHARE DEALING Halifax ShareBuilder Share Dealing Self-Select ISA TAX FREE ISA ... Halifax Share Dealing Limited, Registered in England No ...

Share trading and dealing online from Interactive Investor, the UK share dealing service. Buy shares plus get information, news, tools for trading stocks and share dealing. UK £10 flat fee. ... news and tools from Interactive Investor's (www.iii.co.uk) UK share dealing service. Buy shares online 24/7. Plus: online share trading tools and UK share dealing information ...

Online share-dealing, self-select ISAs with administration service and advice. Includes share price estimator.

Money extra - buy shares and sell shares online, manage portfolio online with real time share quotes ... Stock & shares ISAs - Online share dealing - Financial planner - UK share prices - Stocks at a ... to use share dealing account for regular share dealing and infrequent share traders ..

Provides an execution-only brokerage service though the Internet, WAP, and telephone. Category: Discount Brokerages

Friends Provident, founded in 1832, is one of the UK's leading financial services groups and has two core businesses: Friends Provident Life and Pensions and F&C. ... be bought or sold through the share dealing services outlined below or, if you have a share ... contacting a stockbroker or other authorised share dealing service of your choice ... friendsprovident.co.uk/common/

Norwich and Peterborough are a mutual building society that offer financial services including online share dealing, mortgages, savings, personal and business banking, internet banking, insurance and commercial mortgages. ... If you're looking for an execution-only share dealing service, we can help ... A comprehensive range of share dealing accounts. Share dealing by telephone, over the internet or by post ...

... Stepped Income Reserve Web Saver SECURITY & PRIVACY SHARE DEALING Halifax Sharebuilder Self-Select ISA TOOLKIT TRAVEL ... Halifax Share Dealing Limited, Registered in England No ...

Share Dealing. Q. Do you have a low-cost dealing service? A. Kelda Group plc does not currently offer a low cost dealing service. ... Home > Investors > Shareholder Services > Frequent Questions > Share Dealing ... your bank who may have a share dealing service, or alternatively Capita Registrars who offer ... www.keldagroup.com/kel/investors/

Skip left hand navigation. Saga.co.uk | Important Info | Privacy Policy | Security | Site Map | Contact Us | Help | 0845 900 3002. quick. quotes. Home. Login. Open Account www.sagasharedirect.co.uk

Share prices, the stock market & finding the best investment in the UK - Money Extra ... Stock & shares ISAs - Online share dealing - Financial planner - UK share prices - Stocks at a glance ... to use, instant access online share dealing service, enables you to buy ..

Introduction to share dealing BT itself does not endorse any service for the buying or selling of shares Stockbroking services are available through brokers and banks some of which provide online dealing services Only registered ... Traditional share dealing and share certificates. Traditionally, shares have been held in paper form - a ... btplc.com/Sharesandperformance/... A quick and easy share dealing service for shareholders with share certificates. Terms and conditions will apply.

A quick and easy share dealing service is available to either sell or buy more shares provided by Capita Share Dealing Services.

Additional Internet Terms And Conditions. 1. These Terms and Conditions are additional to the Share Account Terms and Conditions, which were agreed when opening an Account with The Share Centre, and as may have been subsequently amended. ... Virgin Money home. Share Dealing home. What's the deal ... The Virgin Share Dealing service is provided by and administered by The Share Centre Ltd which is a member of the ... www.share.com/virginmoney/terms.htm - 20k

... Cheque Account SECURITY AND PRIVACY SHARE DEALING Halifax ShareBuilder Share Dealing Self-Select ISA TAX FREE ISA ... To register for a Halifax Share Dealing PEP or ISA you'll also

Hargreaves Lansdown: Share Dealing ... Menu Share Dealing Selling Shares Buying Shares Online Share Dealing The information on this ...

Online share dealing - buy shares online cheapest deals online Online Share Dealing. online sharedealing websites A-Z buy your shares from online share dealing websites at a discount.

Share Dealing at Alliance & Leicester plc Telephone or Internet Share Dealing for at Alliance & Leicester customers ... Telephone Share Dealing. The Alliance & Leicester Telephone Share Dealing Service is provided by Barclays ... phone and has been specially designed to make UK share dealing easy ... www.alliance-leicester.co.uk/

Tips and tactics for the financial markets: your complete guide to investing. Data on companies and share prices, market reports, articles on investments, unit trusts, investment trusts, ISAs and how to make the most of your money. ... Authority (FSA). This Is Money Share Dealing Ltd is an appointed representative of The Share Centre Ltd ...

MONEY FINDER

|

||

|

This

website

is Copyright © 1999 & 2006 NJK. The bird |

||

|

AUTOMOTIVE | BLUEBIRD | ELECTRIC CARS | ELECTRIC CYCLES | SOLAR CARS |